Page 2 of 4

Re: Better this, or 100% Inheritance Tax?

Posted: Sun Oct 24, 2021 2:46 pm

by Tessa K

jdc wrote: ↑Sun Oct 24, 2021 2:44 pm

Tessa K wrote: ↑Sun Oct 24, 2021 2:37 pm

jdc wrote: ↑Sun Oct 24, 2021 1:21 pm

So if my dad's estate was worth £425,000 because he'd been lucky enough to buy a house at the right time I shouldn't have to pay £40k to the govt, and they should raise the money they need from the pay packets of nurses and taxi drivers instead?

I mean, imagine poor me being penalised for my dad's good fortune in the housing market and having to inherit only £385,000. How would I cope?

You know that's not an either/or. Getting big companies to pay tax would raise far more.

Let's just tax companies then. Works for me - I don't see why people should be penalised for earning money and you've come up with a way to avoid that.

Now you're just being silly.

Re: Better this, or 100% Inheritance Tax?

Posted: Sun Oct 24, 2021 4:14 pm

by Lew Dolby

and some people are really irrational.

I've got friends (married) both of whom were lucky enough to actually pay IT. They winged like mad. They used the "tax has already been paid" arguement in almost the same breath as the "the only reason IT is payable is because parents house has increased in value so much".

They don't have an answer when you point out the increased wealth from the house hasn't been taxed already.

Dick-heads !!1??!1

Re: Better this, or 100% Inheritance Tax?

Posted: Sun Oct 24, 2021 8:17 pm

by dyqik

jdc wrote: ↑Sun Oct 24, 2021 1:21 pm

Tessa K wrote: ↑Sun Oct 24, 2021 8:31 am

I take all your points. For me, it's the fact that property values have increased so much in the last 50 or 60 years so that small, modest family homes are now over the IT threshold in value in some areas where no one really wanted to live back then but they do now.

So if my dad's estate was worth £425,000 because he'd been lucky enough to buy a house at the right time I shouldn't have to pay £40k to the govt, and they should raise the money they need from the pay packets of nurses and taxi drivers instead?

I mean, imagine poor me being penalised for my dad's good fortune in the housing market and having to inherit only £385,000. How would I cope?

Realistically, to inherit that house, you'll also have to be terribly unlucky/lucky that your dad died suddenly, without needing lengthy care.

Very few "modest" houses owned by parents etc. are going to be inherited whole, given the need to fund end-of-life care. And many won't be inherited until the beneficiaries are downsizing their homes, with their children already having left home.

Unless inheritances start skipping generations, increased life expectancy and costly end-of-life care means that inheritances where they survive are largely going to go to the already secure and established, rather than the young adults just building their life.

(The downpayment on our house came from my wife's grandmother's estate. But my wife's father died when she was 18, so the inheritance passed to her and her sister)

Re: Better this, or 100% Inheritance Tax?

Posted: Sun Oct 24, 2021 8:37 pm

by basementer

Lew Dolby wrote: ↑Sun Oct 24, 2021 4:14 pm

and some people are really irrational.

I've got friends (married) both of whom were lucky enough to actually pay IT. They winged like mad. They used the "tax has already been paid" arguement in almost the same breath as the "the only reason IT is payable is because parents house has increased in value so much".

They don't have an answer when you point out the increased wealth from the house hasn't been taxed already.

Dick-heads !!1??!1

That's an attitude that makes no sense to me.

They didn't pay IT, the estate of the deceased did. It's possible that when my father dies, the current value of the house that he bought in 1966 for about £3,500 will push his estate above the threshold, but it won't be me and basesister who pay the tax.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 9:35 am

by Tessa K

dyqik wrote: ↑Sun Oct 24, 2021 8:17 pm

jdc wrote: ↑Sun Oct 24, 2021 1:21 pm

Tessa K wrote: ↑Sun Oct 24, 2021 8:31 am

I take all your points. For me, it's the fact that property values have increased so much in the last 50 or 60 years so that small, modest family homes are now over the IT threshold in value in some areas where no one really wanted to live back then but they do now.

So if my dad's estate was worth £425,000 because he'd been lucky enough to buy a house at the right time I shouldn't have to pay £40k to the govt, and they should raise the money they need from the pay packets of nurses and taxi drivers instead?

I mean, imagine poor me being penalised for my dad's good fortune in the housing market and having to inherit only £385,000. How would I cope?

Realistically, to inherit that house, you'll also have to be terribly unlucky/lucky that your dad died suddenly, without needing lengthy care.

Very few "modest" houses owned by parents etc. are going to be inherited whole, given the need to fund end-of-life care. And many won't be inherited until the beneficiaries are downsizing their homes, with their children already having left home.

Unless inheritances start skipping generations, increased life expectancy and costly end-of-life care means that inheritances where they survive are largely going to go to the already secure and established, rather than the young adults just building their life.

(The downpayment on our house came from my wife's grandmother's estate. But my wife's father died when she was 18, so the inheritance passed to her and her sister)

Both my parents died recently after relatively short times in care. Many people don't know (and many care homes won't tell you) that when it comes to end of life care, the local authority will pay all costs for a minimum of three months with possible extensions, whatever funds or property the old person has.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 11:51 am

by Woodchopper

Long term residential or nursing care for someone aged over 65 cost an average of £681 per week (residential) £979 per week (nursing), with people who are self-funding paying about 30% more. That's the numbers of England, other regions are cheaper.

https://www.which.co.uk/later-life-care ... dbv8k3kwln

As of 2011 average length of stay in long term care before death was 23 months:

https://www.pssru.ac.uk/pub/3211.pdf

That gives us a range of about £80 000 to £130 000 for a stay of that length.

Average house prices in England are: £423,450 for a detached house or £235,439 for a flat. In London the comparable numbers are £966,217 and £425,304.

https://www.gov.uk/government/news/uk-h ... march-2021

So even after a lengthy stay in residential or nursing care there would still probably be hundreds of thousands left from the sale of a detached house with no mortgage, though much less so for a flat.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 12:15 pm

by Tessa K

Woodchopper wrote: ↑Mon Oct 25, 2021 11:51 am

Long term residential or nursing care for someone aged over 65 cost an average of £681 per week (residential) £979 per week (nursing), with people who are self-funding paying about 30% more. That's the numbers of England, other regions are cheaper.

https://www.which.co.uk/later-life-care ... dbv8k3kwln

As of 2011 average length of stay in long term care before death was 23 months:

https://www.pssru.ac.uk/pub/3211.pdf

That gives us a range of about £80 000 to £130 000 for a stay of that length.

Average house prices in England are: £423,450 for a detached house or £235,439 for a flat. In London the comparable numbers are £966,217 and £425,304.

https://www.gov.uk/government/news/uk-h ... march-2021

So even after a lengthy stay in residential or nursing care there would still probably be hundreds of thousands left from the sale of a detached house with no mortgage, though much less so for a flat.

The home both my parents were in (about a year apart) was £5k a month self-funded - and that wasn't a lot by some standards (it was in a rural area). I suspect the reason some homes don't tell people about the free end of life care is that they get less money from the LA than from private funding. I had to poke them to get them to apply for it for my mum; they should have done it earlier.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 12:58 pm

by dyqik

Woodchopper wrote: ↑Mon Oct 25, 2021 11:51 am

Long term residential or nursing care for someone aged over 65 cost an average of £681 per week (residential) £979 per week (nursing), with people who are self-funding paying about 30% more. That's the numbers of England, other regions are cheaper.

https://www.which.co.uk/later-life-care ... dbv8k3kwln

As of 2011 average length of stay in long term care before death was 23 months:

https://www.pssru.ac.uk/pub/3211.pdf

That gives us a range of about £80 000 to £130 000 for a stay of that length.

Average house prices in England are: £423,450 for a detached house or £235,439 for a flat. In London the comparable numbers are £966,217 and £425,304.

https://www.gov.uk/government/news/uk-h ... march-2021

So even after a lengthy stay in residential or nursing care there would still probably be hundreds of thousands left from the sale of a detached house with no mortgage, though much less so for a flat.

That's why I said "inherited whole". And taking £100k off the price of a "modest" house that just goes above the inheritance tax threshold means it's no longer over the threshold.

In any case, if the house has to be liquidated to pay for care, one (weaker anyway) argument against inheritance tax to do with inheriting the family property and keeping it in the family for sentimental reasons is now moot.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 1:12 pm

by Woodchopper

dyqik wrote: ↑Mon Oct 25, 2021 12:58 pm

Woodchopper wrote: ↑Mon Oct 25, 2021 11:51 am

Long term residential or nursing care for someone aged over 65 cost an average of £681 per week (residential) £979 per week (nursing), with people who are self-funding paying about 30% more. That's the numbers of England, other regions are cheaper.

https://www.which.co.uk/later-life-care ... dbv8k3kwln

As of 2011 average length of stay in long term care before death was 23 months:

https://www.pssru.ac.uk/pub/3211.pdf

That gives us a range of about £80 000 to £130 000 for a stay of that length.

Average house prices in England are: £423,450 for a detached house or £235,439 for a flat. In London the comparable numbers are £966,217 and £425,304.

https://www.gov.uk/government/news/uk-h ... march-2021

So even after a lengthy stay in residential or nursing care there would still probably be hundreds of thousands left from the sale of a detached house with no mortgage, though much less so for a flat.

That's why I said "inherited whole". And taking £100k off the price of a "modest" house that just goes above the inheritance tax threshold means it's no longer over the threshold.

In any case, if the house has to be liquidated to pay for care, one (weaker anyway) argument against inheritance tax to do with inheriting the family property and keeping it in the family for sentimental reasons is now moot.

Yes, I wasn't intending to disagree with you. I just thought it might be good to post some actual numbers.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 1:35 pm

by dyqik

Woodchopper wrote: ↑Mon Oct 25, 2021 1:12 pm

dyqik wrote: ↑Mon Oct 25, 2021 12:58 pm

Woodchopper wrote: ↑Mon Oct 25, 2021 11:51 am

Long term residential or nursing care for someone aged over 65 cost an average of £681 per week (residential) £979 per week (nursing), with people who are self-funding paying about 30% more. That's the numbers of England, other regions are cheaper.

https://www.which.co.uk/later-life-care ... dbv8k3kwln

As of 2011 average length of stay in long term care before death was 23 months:

https://www.pssru.ac.uk/pub/3211.pdf

That gives us a range of about £80 000 to £130 000 for a stay of that length.

Average house prices in England are: £423,450 for a detached house or £235,439 for a flat. In London the comparable numbers are £966,217 and £425,304.

https://www.gov.uk/government/news/uk-h ... march-2021

So even after a lengthy stay in residential or nursing care there would still probably be hundreds of thousands left from the sale of a detached house with no mortgage, though much less so for a flat.

That's why I said "inherited whole". And taking £100k off the price of a "modest" house that just goes above the inheritance tax threshold means it's no longer over the threshold.

In any case, if the house has to be liquidated to pay for care, one (weaker anyway) argument against inheritance tax to do with inheriting the family property and keeping it in the family for sentimental reasons is now moot.

Yes, I wasn't intending to disagree with you. I just thought it might be good to post some actual numbers.

I think you also need to multiply your total by two in most cases, as a house owned by a couple is likely going to end up paying for two people's care.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 1:54 pm

by Woodchopper

dyqik wrote: ↑Mon Oct 25, 2021 1:35 pm

Woodchopper wrote: ↑Mon Oct 25, 2021 1:12 pm

dyqik wrote: ↑Mon Oct 25, 2021 12:58 pm

That's why I said "inherited whole". And taking £100k off the price of a "modest" house that just goes above the inheritance tax threshold means it's no longer over the threshold.

In any case, if the house has to be liquidated to pay for care, one (weaker anyway) argument against inheritance tax to do with inheriting the family property and keeping it in the family for sentimental reasons is now moot.

Yes, I wasn't intending to disagree with you. I just thought it might be good to post some actual numbers.

I think you also need to multiply your total by two in most cases, as a house owned by a couple is likely going to end up paying for two people's care.

Yes, that's a good point.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 1:55 pm

by Gfamily

dyqik wrote: ↑Mon Oct 25, 2021 1:35 pm

Woodchopper wrote: ↑Mon Oct 25, 2021 1:12 pm

dyqik wrote: ↑Mon Oct 25, 2021 12:58 pm

That's why I said "inherited whole". And taking £100k off the price of a "modest" house that just goes above the inheritance tax threshold means it's no longer over the threshold.

In any case, if the house has to be liquidated to pay for care, one (weaker anyway) argument against inheritance tax to do with inheriting the family property and keeping it in the family for sentimental reasons is now moot.

Yes, I wasn't intending to disagree with you. I just thought it might be good to post some actual numbers.

I think you also need to multiply your total by two in most cases, as a house owned by a couple is likely going to end up paying for two people's care.

"... in most cases" ? What proportion of people move into a Care home?

ETA - figures online suggest it's very much a minority - 5% or less.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 2:15 pm

by dyqik

Gfamily wrote: ↑Mon Oct 25, 2021 1:55 pm

dyqik wrote: ↑Mon Oct 25, 2021 1:35 pm

Woodchopper wrote: ↑Mon Oct 25, 2021 1:12 pm

Yes, I wasn't intending to disagree with you. I just thought it might be good to post some actual numbers.

I think you also need to multiply your total by two in most cases, as a house owned by a couple is likely going to end up paying for two people's care.

"... in most cases" ? What proportion of people move into a Care home?

ETA - figures online suggest it's very much a minority - 5% or less.

It's > 90% in my family. The only person (out of more than 10 grandparents and great aunts and uncles) who didn't move into a care or nursing home died suddenly aged 67 (and who left no estate because he'd been unable to work following multiple heart attacks and angina aged 40). All of the rest had at least 3 months in care facilities, with several needing high level care for severe dementia/Alzheimers. That's not counting years in assisted living.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 2:33 pm

by dyqik

dyqik wrote: ↑Mon Oct 25, 2021 2:15 pm

Gfamily wrote: ↑Mon Oct 25, 2021 1:55 pm

dyqik wrote: ↑Mon Oct 25, 2021 1:35 pm

I think you also need to multiply your total by two in most cases, as a house owned by a couple is likely going to end up paying for two people's care.

"... in most cases" ? What proportion of people move into a Care home?

ETA - figures online suggest it's very much a minority - 5% or less.

It's > 90% in my family. The only person (out of more than 10 grandparents and great aunts and uncles) who didn't move into a care or nursing home died suddenly aged 67 (and who left no estate because he'd been unable to work following multiple heart attacks and angina aged 40). All of the rest had at least 3 months in care facilities, with several needing high level care for severe dementia/Alzheimers. That's not counting years in assisted living.

I should also say that most of my family have lived well into their 80s, despite close calls with cancer before that. And my direct grandparents, apart from my grandfather mentioned above, all lived into their mid to late 90s.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 2:37 pm

by Woodchopper

Gfamily wrote: ↑Mon Oct 25, 2021 1:55 pm

dyqik wrote: ↑Mon Oct 25, 2021 1:35 pm

Woodchopper wrote: ↑Mon Oct 25, 2021 1:12 pm

Yes, I wasn't intending to disagree with you. I just thought it might be good to post some actual numbers.

I think you also need to multiply your total by two in most cases, as a house owned by a couple is likely going to end up paying for two people's care.

"... in most cases" ? What proportion of people move into a Care home?

ETA - figures online suggest it's very much a minority - 5% or less.

A source for that figure is here:

https://publications.parliament.uk/pa/c ... 70/370.pdf page 39.

However, it states that "Currently, only around 5% of the over-65 population live in all types of specialist housing,". That's possible as the great majority of people aged 65 don't need specialist housing and older people in, say their 80s, who do need it only use it for relatively short periods.

Its not the case that only 5% of people will need specialist housing at some point in their lives.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 3:39 pm

by Gfamily

Woodchopper wrote: ↑Mon Oct 25, 2021 2:37 pm

Gfamily wrote: ↑Mon Oct 25, 2021 1:55 pm

dyqik wrote: ↑Mon Oct 25, 2021 1:35 pm

I think you also need to multiply your total by two in most cases, as a house owned by a couple is likely going to end up paying for two people's care.

"... in most cases" ? What proportion of people move into a Care home?

ETA - figures online suggest it's very much a minority - 5% or less.

A source for that figure is here:

https://publications.parliament.uk/pa/c ... 70/370.pdf page 39.

However, it states that "Currently, only around 5% of the over-65 population live in all types of specialist housing,". That's possible as the great majority of people aged 65 don't need specialist housing and older people in, say their 80s, who do need it only use it for relatively short periods.

Its not the case that only 5% of people will need specialist housing at some point in their lives.

A good point. Need to see if we can find where people were living at end of life.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 3:41 pm

by science_fox

My work is offering a free will-writing service, which I don't really need since all my possessions will transfer to my married OtherHalf, but thought I do anyway just in case. The lawfirm involved is very heavily pushing establishing a trust such that the house cannot be used to pay for residential care. Such things apparently cost £700 or so to set up, well within the reach of most families who have a mortgage rather than just the 1%ers. So many houses may be left entire to the next generation.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 3:47 pm

by dyqik

Gfamily wrote: ↑Mon Oct 25, 2021 3:39 pm

Woodchopper wrote: ↑Mon Oct 25, 2021 2:37 pm

Gfamily wrote: ↑Mon Oct 25, 2021 1:55 pm

"... in most cases" ? What proportion of people move into a Care home?

ETA - figures online suggest it's very much a minority - 5% or less.

A source for that figure is here:

https://publications.parliament.uk/pa/c ... 70/370.pdf page 39.

However, it states that "Currently, only around 5% of the over-65 population live in all types of specialist housing,". That's possible as the great majority of people aged 65 don't need specialist housing and older people in, say their 80s, who do need it only use it for relatively short periods.

Its not the case that only 5% of people will need specialist housing at some point in their lives.

A good point. Need to see if we can find where people were living at end of life.

You can mostly back it out for the purposes of hand-waving estimates here from the UK's 20 year life expectancy at age 65, an average 2 year stay in care, and 5% of the over 65 population in specialist housing at any one time - half the population that reaches 65 goes into a care situation for 10% of their post-65 life. (I guess the 5% could include assisted living (e.g. warden care flats), which aren't that much more than general housing, rather than expensive care homes or nursing homes)

Which I guess means that Woodchopper's estimate of total cost doesn't need to be doubled.

Of course, we're ignoring inheritances from those that die before 65, but we're also making the assumption above that the over-65s are mortgage free. And life insurance comes into play as well. But I don't think we're trying to build a full economic model.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 3:48 pm

by dyqik

science_fox wrote: ↑Mon Oct 25, 2021 3:41 pm

My work is offering a free will-writing service, which I don't really need since all my possessions will transfer to my married OtherHalf, but thought I do anyway just in case. The lawfirm involved is very heavily pushing establishing a trust such that the house cannot be used to pay for residential care. Such things apparently cost £700 or so to set up, well within the reach of most families who have a mortgage rather than just the 1%ers. So many houses may be left entire to the next generation.

Until the government cracks down on that because end-of-life care ends up being unfunded.

Re: Better this, or 100% Inheritance Tax?

Posted: Mon Oct 25, 2021 4:18 pm

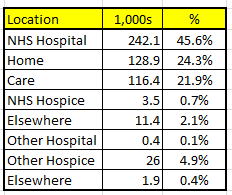

by Gfamily

Gfamily wrote: ↑Mon Oct 25, 2021 3:39 pm

A good point. Need to see if we can find where people were living at end of life.

From

https://www.statista.com/statistics/285 ... -of-death/

Table of figures

Code: Select all

Location 1,000s %

NHS Hospital 242.1 45.6%

Home 128.9 24.3%

Care Home 116.4 21.9%

NHS Hospice 3.5 0.7%

Elsewhere 11.4 2.1%

Other Hospital 0.4 0.1%

Other Hospice 26 4.9%

Elsewhere 1.9 0.4%

- locations.PNG (7.49 KiB) Viewed 1564 times

Re: Better this, or 100% Inheritance Tax?

Posted: Wed Oct 27, 2021 12:39 pm

by Bird on a Fire

NHS hospital is a tricky category, because staying there is free and I presume it wouldn't be someone's legal residence.

Seems like a roughly 50:50 split between homes and care homes, especially if (at a guess) people in care homes are on average a bit more likely to need hospitalisation.

Re: Better this, or 100% Inheritance Tax?

Posted: Wed Oct 27, 2021 12:52 pm

by Gfamily

Bird on a Fire wrote: ↑Wed Oct 27, 2021 12:39 pm

NHS hospital is a tricky category, because staying there is free and I presume it wouldn't be someone's legal residence.

Seems like a roughly 50:50 split between homes and care homes, especially if (at a guess) people in care homes are on average a bit more likely to need hospitalisation.

Interesting. My view is that Care homes would be

significantly less likely to move people to a hospital for end of life care.

I was thinking it would have been more like 2/3 not going into care homes.

Of deaths over the last decade or so in my family, three were in Care/Nursing homes (two long care, one within weeks of moving in), one death at home after a long illness, two in hospital after heart attack/stroke, and one elsewhere.

Re: Better this, or 100% Inheritance Tax?

Posted: Wed Oct 27, 2021 12:56 pm

by dyqik

Bird on a Fire wrote: ↑Wed Oct 27, 2021 12:39 pm

NHS hospital is a tricky category, because staying there is free and I presume it wouldn't be someone's legal residence.

Seems like a roughly 50:50 split between homes and care homes, especially if (at a guess) people in care homes are on average a bit more likely to need hospitalisation.

I was thinking a bit about that, but didn't respond. There are grades of care homes - regular "care" homes can't deal with much nursing type things, and will send residents to hospital for the final few weeks or when things get too serious for them (but would move residents to nursing homes for more extended nursing care). Nursing homes can deal with much of the hospice type end-of-life care without resorting to hospitals (all of my grandparents that were in nursing homes died in them, with one moving to a nursing home from a warden care flat for her last month or two). Their residents may tend to move to hospitals only when there's a plan of more intense treatment, or when surgeries etc. offer some hope of partial recovery.

Obviously more rapid declines are more likely to result in moves from home to hospital directly, without care homes in-between. It's also common to go to hospital in the initial stages of something, and then leave hospital after a partial recovery or stabilization to move to a care home, sometimes only for an extended recovery period before returning home

So, yes, many of those that die in NHS hospitals will have arrived from care homes, maybe fewer proportionally from nursing homes. And I wouldn't be surprised if the numbers arriving directly from private homes were higher in proportion.

And you also have to think about where the lighter end of assisted living fits into all this - warden care flats, etc. aren't care homes, but they also aren't really private homes that can be inherited, as they are usually rented.

(ETA: cross-posted with GFamily)

Re: Better this, or 100% Inheritance Tax?

Posted: Wed Oct 27, 2021 1:00 pm

by Bird on a Fire

Hmm, fair enough. I may be wrong. It was the same in my family to be fair, grandad from home to hospital, granny stayed in the care home.

Re: Better this, or 100% Inheritance Tax?

Posted: Wed Oct 27, 2021 1:36 pm

by Tessa K

Gfamily wrote: ↑Wed Oct 27, 2021 12:52 pm

Bird on a Fire wrote: ↑Wed Oct 27, 2021 12:39 pm

NHS hospital is a tricky category, because staying there is free and I presume it wouldn't be someone's legal residence.

Seems like a roughly 50:50 split between homes and care homes, especially if (at a guess) people in care homes are on average a bit more likely to need hospitalisation.

Interesting. My view is that Care homes would be

significantly less likely to move people to a hospital for end of life care.

I was thinking it would have been more like 2/3 not going into care homes.

Of deaths over the last decade or so in my family, three were in Care/Nursing homes (two long care, one within weeks of moving in), one death at home after a long illness, two in hospital after heart attack/stroke, and one elsewhere.

At the care home my parents were in, end of life care was provided (and funded by the local authority even for self-funding residents). I was asked with both of them if I wanted them to go to hospital close to the end to try and keep them going with treatment or whether they should 'let nature take its course'. The first time I didn't realise what this meant but then I found out and requested the Nature option for both of them. This means making them comfortable with as much morphine etc as is legally allowed and then withdrawing food and water. Once this happens, it's just a matter of days. It's a tough call to make, especially if the person in the home isn't in a state to say what they want, but it does give you a few days to make preliminary arrangements, let other friends and family know. There was a GP in attendance at the home to monitor the situation and prescribe the morphine etc so it wasn't just up to the staff.